The AMM Trading Guide

AMM stands for Automated Market Maker. AMMs are widely used in crypto by decentralized exchanges to allow token swapping. The concept was adopted by NFT marketplaces and apps too. They allow a similar scheme for NFTs where you can go in and out easily.

The main issue of NFT collections is that they lack liquidity, they are seen as illiquid assets because they are hard to sell. By providing sols and a bunch of NFTs for each collection, AMMs allow anyone to get in and out of a collection without waiting for a seller.

To accumulate the necessary funds and NFTs, AMM apps require external contributions. To encourage people to contribute, AMMs reward anyone providing liquidities or NFTs.

But how does it work? How can you take advantage of your contribution? This is what we are going to explain in this guide. The first part will take you into the mechanics of the AMM and will help you to understand how it works. The second part will show you how to set up automated investment strategies with AMMs.

NB: Another cool thing offered by AMMs is that it allows any marketplace users to swap common NFTs for something they like better.

AMM Platforms

The most used AMMs platforms are: Tensor, Elixir, and Hadeswap. They all provide extensive guides and documentation, so I won’t cover how to use them. I will describe only the theory behind it.

I tend to prefer Tensor because it is linked to my favorite marketplace. The Elixir UI is great too, and makes item swap easier. Hadeswap is of course a nice alternative.

AMM Mechanism

Before AMMs, it wasn't straightforward if you wanted to get or sell an NFT quickly. Selling required to find a vendor, and buying at floor price offered very few options. With AMMs, you can instantly sell your NFT and always have a good bunch of choices when entering a collection. In this section, we will see how it allows instant selling and simplified buying.

Collection-wide bids

The collection-wide bidding system is the first function that allows NFT holders to instant sell. It allows people to provision a bid that will act as some sort of limit-buy for a collection. The fact that one can put sols and set a buying price allows anyone else to accept the already set bids instantly. Most of the time, the propositions are slightly below the floor, but they are still interesting for a quick sell.

Bidding can be set for multiple NFTs. For this, some parameters can be set , like bid caps, to limit the number of buys in case of floor dumps. Another very interesting parameter is the progressive rate. You can decide to buy 10 items while reducing your bid after each buy. The bid modification can be done linearly by giving an amount of $SOL to remove each time or by percentage by giving a proportion of the price reduction.

Example: Let’s say you put a bid to buy 3 LilyNFT at 11 and asking for a 1$SOL modification. It will lead you to buy an item at 11, the second at 10, and the third at 9.

Progressive Listing

Listing is available on any platform, but some marketplaces propose is to sell at a progressive rate. For instance you can list 5 NFTs and sell them with an increased price each time an NFT is sold.

Example: Let’s say you sell 3 LilyNFT at 13 and ask for a 1$SOL modification, it we’ll lead you to sell an item at 13, the second at 14, and the third at 15.

Two-sided orders: Market Makers

Basically, a Market Maker for a collection is the combination of the two previous mechanisms. They propose you set a pool with, on one side an amount of $SOL and, on the other side, a bunch of common NFTs for this collection. This pool is coupled with a progressive bid for buying NFTs to handle the case where the floor goes down and a progressive sell NFTs when the floor goes up.

The MM comes with an additional parameter named “delta”. It makes the buy bid tied to the selling price. It applies a change when your buying bid decreases, your selling price decreases too, and vice-versa if your selling price increase. That way you keep following floor variation to ensure that you still provide liquidity to it (until you do not have enough sols for that). And each time, you collect the difference between your buying and your selling.

Exemple: Let’s say you create a pool with 36 $SOL and 3 LilyNFT. With a buying bid at 12 and a selling bid at 14 and a delta at 2 and a progression of 1 after a transaction. When you sell an NFT, the bid increases to 13, and your next selling price is 15. Let’s say someone sells you a NFT at 13, the bid decreases to 12, and your next selling price is 14. Now let’s say someone sells you two NFTs, your bid decreases to 10, and your selling price decreases to 12.

See the Tensor documentation, 2 for more examples

AMM

The AMM is the protocol that all market makers use. It’s the thing that allows to set orders and pools.

Difference between linear and percentage progressions

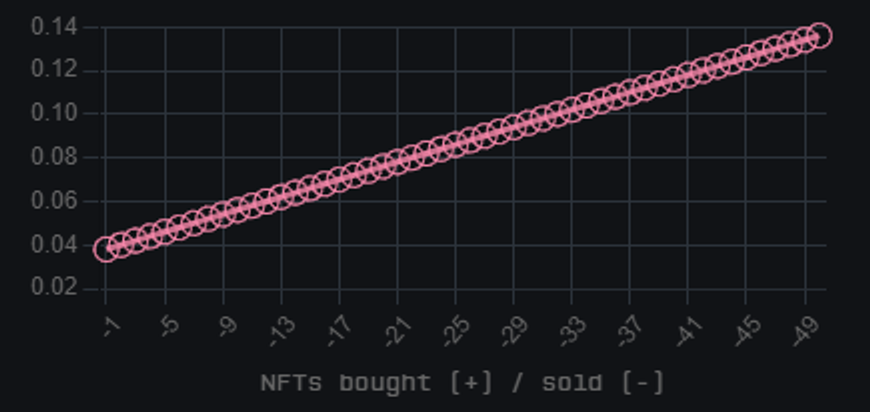

Linear

The linear progression is pretty straightforward to understand

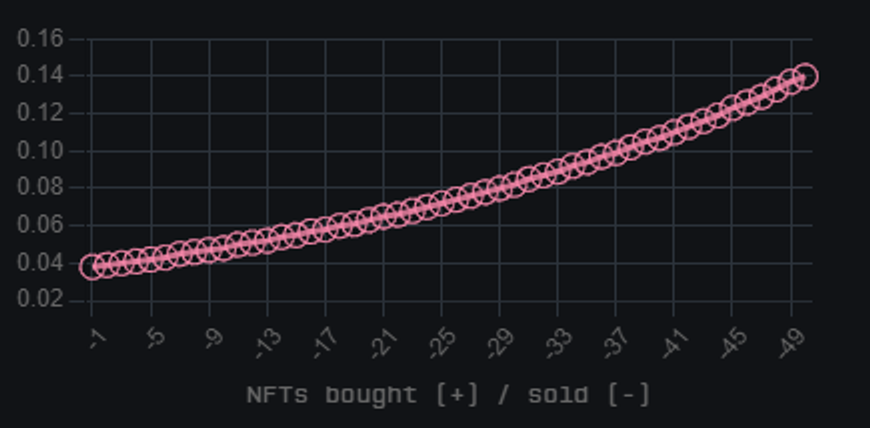

Percentage

The percentage one is very tied at the beginning but will make your selling harder and harder (note that it is exponential). Depending on your parameters, your last NFT may never sell. This means that it limits risks and stops buying or selling if things move too fast.

How to take advantage of AMMs

Put a decent amount of liquidity

First and foremost, to use AMMs, you need a good amount of sols compared to the collection floor price. You will provide liquidity and need flexible in and out prices to make it efficient. The more liquidity you put in the pool, the wider swings you can follow.

The best option is to put at least 10 NFTs. It works with less but you will be limited. A number between 10 an 100 is better in terms of flexibility

Decide about your spread (named fees on some platforms)

The more spread you ask, the harder it will be to get your bids and sells accepted but the more rewarding it will be. It will require higher volatility of the collection to see your orders activated. It’s up to you to find the right balance.

Chose a collection you believe in

The thing to get is that the more the floor price goes down, the more NFTs you get into the pool. It’s like buying regularly into the collection. Oppositely, the more the floor price goes up, the more you sell NFTs. You gradually sell your holdings. But in both situation, the pool stay active, so things can go back to normal.

The only way to not feel bad in case the floor going down is to set it on a collection you like. The worst-case scenario will be to have accumulated NFTs from this collection.

Set your strategy

Bet on spread fees

The logic of AMMs is that you create your pool for the long term. So, the most common strategy is to add a large pool that will cover a wide range of floor variations. That way, you will be able to collect fees on a regular basis. You will see your sols increasing and decreasing significantly. It’s up to you to decide when you want to stop. What is beautiful is that if it works well, it generates revenue on a regular basis and constitutes a passive income.

Of course, for this strategy to be efficient, you will have to bet on collections with a high volume.

Swing trading

If the collection evolves by doing up and down in the same range, with a high delta parameter, you can choose to automate your swing trading. You sell when the floor is high, and you buy when it’s low. The risk there is that the floor escapes your swing range. In that case, you will end with lot of NFTs of the collections or only sols. You must be ready to both situations.

DCA into a collection while getting fees

If you like a collection and see that it is dumped for wrong reasons, you may want to get into it progressively. For that you can set a pool, get some m

Gradually sell a collection while getting fees

If you think that a collection is in phase of accumulation before pumping, you can accumulate spread flips during the accumulation phase, and while automatically gradual selling.

Chose your parameters

Depending on your strategy and your level of risk, you will choose different parameters:

- Percentage or linear. Curves are more protective and linear more efficient)

- Spread. A higher spread is more rewarding but will lead to fewer trades

- Delta. A higher delta will be more protective but will lead to fewer trades.

I encourage you to read this page from the Tensor documentation. It will give you detailed information about the impact of parameters on your strategy.

Collect fees and/or close the pool

Once you are satisfied with your setup, collect the spread fees regularly. Then close the pool when you’re happy with your current state ($SOLs or NFTs collected).

If you figure out that you messed up with the parameters or things turned wrong (like collection rugging), accept you lost some part of your investment and close the pool.

Conclusion

AMMs are powerful to automate your trading. Better, they allow you to contribute to the NFT ecosystem by making transactions easier to perform. However, they require attention and must be verified regularly to be fully efficient.

It comes with a new opportunity to collect spread fees on swaps you facilitated, adding new possible strategies for your portfolio.

By working for you, they are great to scale your trading strategy, but still, they require more thinking and preparation before being used. I encourage you to experiment with them first before getting too heavy on it (you can diversify your pools too, like in any investment).

And of course, as usual, invest only money you can afford to lose, they don’t guarantee anything against collection falldown.

We’re done with this guide! I hope it will help you to set up your AMM strategy and build a strong revenue stream. If you enjoy it, please check my other guides below and follow me on Twitter. I share news and tips on a regular basis!

All contents are licensed under Creative Commons by-sa.