DLMMs - Multiday Positions

Disclaimer

This guide was written by linclonlogging, an active DLMMer on Meteora. He has a unique approach to DLMMing that demonstrated strong returns. That's why I think it's worth sharing. He gently allowed me to publish his guide on The Wise Trade. But you have to keep in mind that it comes from his own experiments and discussions. There is no guarantee that it will work for you and he is not responsible for your losses.

DLMM and Chill: A guide to low stress, profitable LPing

Everyone hates losing money. Memecoins can be some of the most volatile assets in the world, so market making them is a constant game of balance between greed and fear. I hated watching shitcoins drop 30% in a minute and watching my position tank in value. I waited for the bounce… another 20% down.

Wanting to escape the acute stress, I tried opening my positions wider, giving the token more room to fall before I start to worry. This method lets you leave the position open for longer, lets you step away from the computer. You start to leave it on while you sleep. You start to leave it on for days.

I have made considerably more money running a conservative strategy than I did chasing tight ranges and fresh shitcoins 30 minutes out of migration. I'd like to help you do the same.

The "Bread 'n Butter"

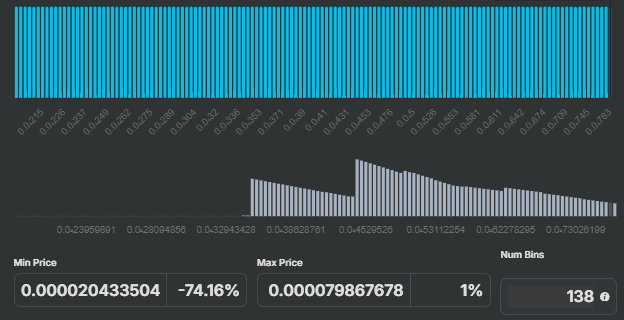

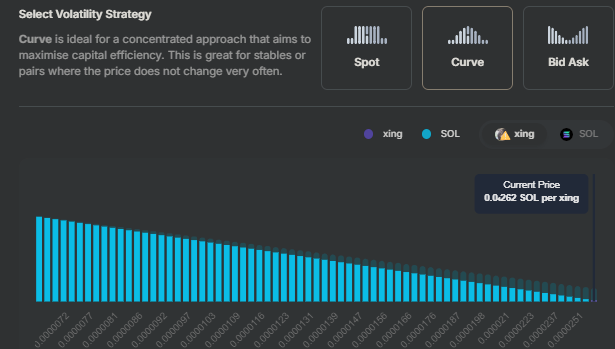

One strategy is the -74% down single sided sol spot position. This is an example of what the position looks like when adding liquidity. There are a few reasons I believe this works so well.

First, the wide range. Creating a wide range serves two purposes: to reduce loss and to allow continuous fee earning. You can set this range and step away for several hours without worrying about the token falling and pushing you out of range.

This range also reduces your losses from the token falling because you acquire more tokens at lower prices. I don't like saying impermanent loss, I think it downplays the severity of this affliction. You accumulate capital losses when the token falls and you aren't hedging that risk away with a short position.

Ranges that are -30% or -40% down will cause you to acquire your tokens at higher prices because you have more sol in those higher bins, assuming you are depositing the same in either case. This higher cost basis means you accumulate more loss as it trends down.

Considerations:

- You can easily make small adjustments here. I personally will throw the range down a bit more if I am nervous, into the 76-80% area.

- I also may bring it in a bit, towards 65-70% if I am confident or want to avoid a bin array fee.

- The picture above involves a 100 binstep pool. I prefer to use 80, 100, and 125 binsteps over any other.

- In my experience the lower binstep allows more precise tracking of the market price for the token, allowing you to gather a bit more in fees compared to a larger bin step.

This makes two positions, which will give you two rent fees:

I primarily target 2% and 5% pools, occasionally 1% pools. I've found smaller fees force you to concentrate to make any money, which I have not experimented with. If you do this let us know how it goes!

Single Sided Positions

Single sided is key. When creating two sided positions you immediately turn half (or less/more) of your liquidity into the token. This gives you a hefty price exposure to the memecoin. If the token falls 50%, you already are experiencing a 25% loss on the tokens before accounting for the position's IL. My portfolio was sideways for a month as I tried to run 50/50 positions, however when I turned to single sided it started for the upside.

By going single sided, you completely eliminate that upfront risk, allowing you to isolate your exposure more to the LP rather than speculation. Many, many LPers recommend single sided positions, and I do too. The downside here is that you take away some of the upside potential. It's critical that I said some, as you still can make money on a moon.

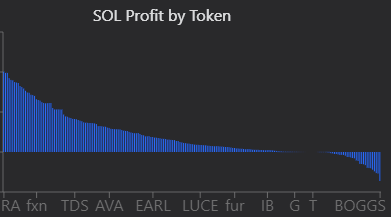

If the token dips into your position for a few hours, you accumulate fees in the token and sol. If it then pumps 400%, your fees have now appreciated greatly, and your IL disappears. I have had positions where the token dropped 60%, I made a shit ton of token fees, then it rallies up to double where my position's top range was, bagging me a 100% return in a day. This is paltry compared to what some other LPers can get, but its significant when you consider that this strategy will massively reduce your losses on most tokens you LP. You will likely make money on most of the tokens you LP with the Bread'n Butter. How do I know?

This is out of over 1,000 positions, and hundreds of individual tokens.

EDIT

The market has deteriorated since I wrote this section. I recommend trying the sawtooth bid ask and the regular bid ask below before employing this spot strategy. If the market is good and coins are generally staying flat or going up, this will make you more fees. On the other hand, it will hurt more if coins are going down.

The Bid Ask (200-400 binstep)

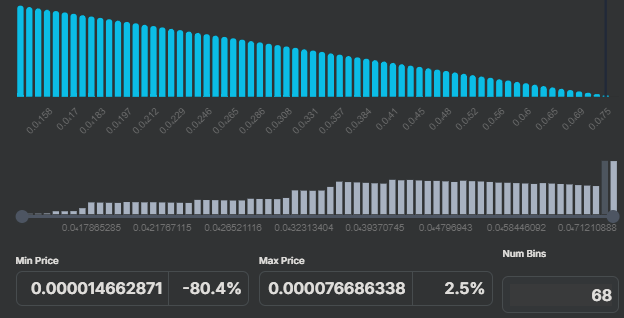

Bid ask positions are more complicated than the spot positions. They entail concentrating your liquidity at the bottom of the range, allowing you to pick up more fees and tokens at a lower price. This pretty drastically reduces IL, as your exposure for the first half of the position is relatively small.

I use bid asks when I don't trust the token enough to acquire it at higher prices, when I am nervous about it. You start by adding most of your liquidity as a bid ask 80% down, 69 bins (250 binstep).

Then, I like to add a bit of extra liquidity into those first few bins, so I make some fees if the token dips a little and pumps out, or doesn't fall very far over the next few hours.

I currently do 87.5% of the position as a bid ask, then the remaining 12.5% as a curve. You can do this by opening up the position you just made and adding some more as a curve on top of the bid ask.

Considerations:

- As before, adjustments are encouraged. Tinker with the range and curve ratio to find what you like the most.

- Be careful opening bid asks over 2 positions. There is currently a bug in meteora that will show you a smooth curve over the 2 or more positions, but when it creates the positions it ends up as a sawtooth pattern.

- This is because the second position is created starting from 0, not from the last bin of your first position. You won't have a smooth curve, but that's not really a bad thing.

- You can use this to create a sawtooth bid ask.

The Sawtooth Bid Ask (80-125 binstep pools)

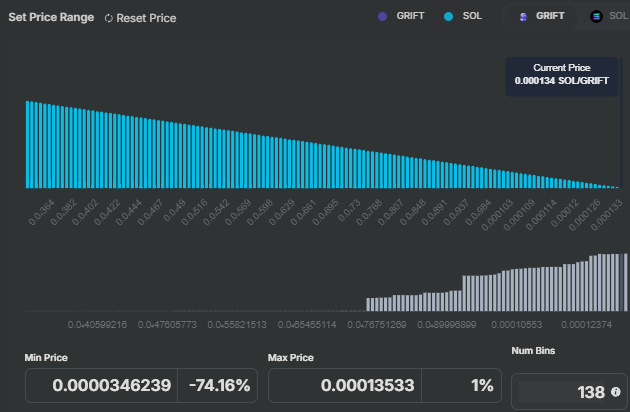

This has been my new main strategy for the last few weeks. It's simple to set up, just add bid ask liquidity over 2 positions (138 bins), with the bottom range at -74% (for a 100 binstep pool).

This will create a sawtooth bid ask, as the second 69 bins will start from 0 rather than where the last bin of the first 69 bins left off. This is useful for reducing risk, as with a bid ask you already buy most tokens at a lower price, but with the sawtooth you are buying even more of your tokens at a lower price.

There are three main ways this may go:

- The token falls a little, maybe all the way through the first position. You make fees on the first part of your liquidity, but most is untouched. This will make a small amount of fees with very little IL.

- The token falls a lot, maybe near the end of the second position. You pull in a large amount of fees and accumulate cheap tokens. If you are confident for a rebound, consider flipping the bid ask and selling the tokens you have accumulated at a higher price. This would lock in capital gains and let your fees appreciate too.

- The token moves up. You may get a little in fees if it dipped into your range, or you may make nothing. The key here is that you didn't lose anything. Tight two sided positions will benefit greatly from a price increase, but they will eat shit and die from a price dump. If the price dumps, which it usually does, you will be far better off employing this strategy.

The 20/.2 "ewan" strategy

Popularized by itsewan in the goosedao, this strategy focuses on LPing medium to large cap tokens with low fee pools. The alpha here is that raydium charges 0.25% on each swap, while this pool would only charge 0.2%.

This means that the meteora pool will be preferred against the raydium pool, stealing its organic swaps when there is sufficient tvl. This, combined with arb trades and sandwich bots, produces a great amount of volume, for which you take 0.2% of each swap.

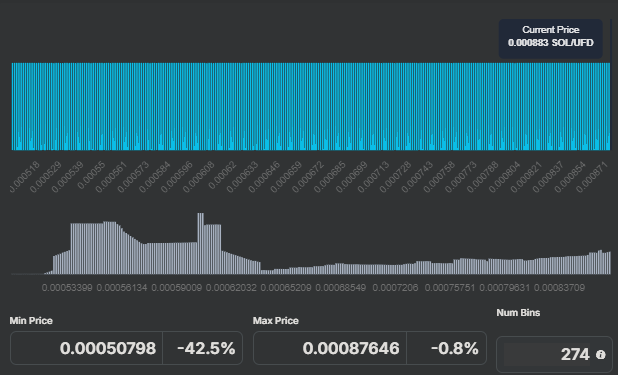

In order for these pools to print they need consistent volume, with no more than 1 empty candle at a time. You ideally want multiple swaps every minute, with those having good size. Recently UFD has been the holy grail of this strategy: ranging from 60-200M MC the volatility is there, and the swaps are too.

The main way we employ this in the goosedao is with spot liquidity spread over 1-4 positions. You can concentrate more if you believe the token may stay within a price range for some time, or you may spread it out to reduce risk and keep the position on longer without maintenance.

I prefer 3-4 positions, which makes the bottom either -33% or -42%.

Some gooses like to start with 1 or 2 positions, and add more as the price drops. This allows them to be more dynamic and concentrated, as they can change their liquidity distribution on the fly and help maximize fees by keeping most liquidity around the price, with lesser amounts on each side to catch outlier moves.

Creating a 20/.2 position may look like this (20 binstep pool, 0.2% fee).

I personally use more size in these compared to my positions on degen shitters, about 3-4x as much. These tend to stay within range due to the tokens being a higher MC, and will print tons of fees.

The market cap we have been using has included as low as 30M and as high as 1.2B. It really just depends on the volatility of the token and how much we trust it. PNET was a rug that many gooses lost money on, while UFD and Griffain have printed so much alone that any loss in PNET could be recovered. Try pooling multiple tokens with 20/.2s to reduce the risk of any single position rugging. These also tend to do well with sol volatility, such as a price dump. Be prepared though, volume will increase but you will often see these tokens go down with sol. I recommend having a solana short to hedge off some of this risk, something I do myself.

You need to chill to run this strat. If you constantly try to manage you will probably end up realizing a lot of IL unnecessarily. I have found the best way to run this is to let it make fees and add liquidity if it moves out of the bottom. However, you have to know when to cut the loss. This will not always work, please don't ride a token to zero.

Managing Positions

My management style is very simple. I claim my fees regularly 3 times per day: When I wake up, at a halfway point (4PM my time), and when I go to sleep. I also claim them whenever a significant amount piles up, such as if I get 5% of my TVL in fees in a short amount of time.

I sell my token fees straight to sol. I do not compound. I enjoy bagging the fees to cover if the token rugs, rather than chasing more income. I encourage you to try compounding if you are willing to chase the higher profit potential.

Advanced Management:

- I sometimes "roll positions". If I have 2 positions open, such as the bread 'n butter, and the token moves out of both, I will withdraw and close the top/first position and sell to sol.

- Then, add a new position below the position still open for another 69 bins. I add half of my starting liquidity to this new position.

- Keep the sol you got from the tokens you withdrew for other positions. This has given you another 69 bins of liquidity in case the token continues to fall, but still maintains some of your exposure to the token.

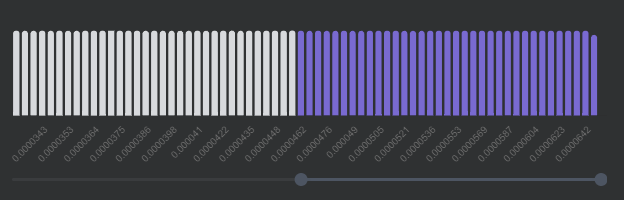

- You can remove liquidity from the top bins of positions and sell if you want to reallocate that capital or reduce risk. With the new update, that is easy to do: Click show bins in the withdraw screen and select some bins to take out.

- Also consider doing the toothpaste strategy. At around the halfway point in your bid ask position, withdraw the tokens only. Then, add them back as a spot position. This allows you to sell the tokens you bought for generally lower prices for higher prices, giving you a capital gain on the curve itself.

- You can also withdraw only some of the tokens from those bins using the % buttons or by typing a %.

How to not get rekt: Token Selection

Choosing which coins to DLMM is arguably more important than the strategy you use within the pool. I have a set of criteria I use to determine what to LP:

- At least $2M MC

- Migration at least 6 hours ago - prefer 8 or more

- Regular swaps in the pool: no more than ~20 minutes between

- At least $2k volume moving average on 1 minute candles - prefer $4k

The market cap is very important. Shitter tokens in the hundred thousands tend to be more unpredictable and have less traders on them. Big holders may feel momentum has stalled and jeet, leaving you burned. I open no less than $2M tokens, I prefer around $8M.

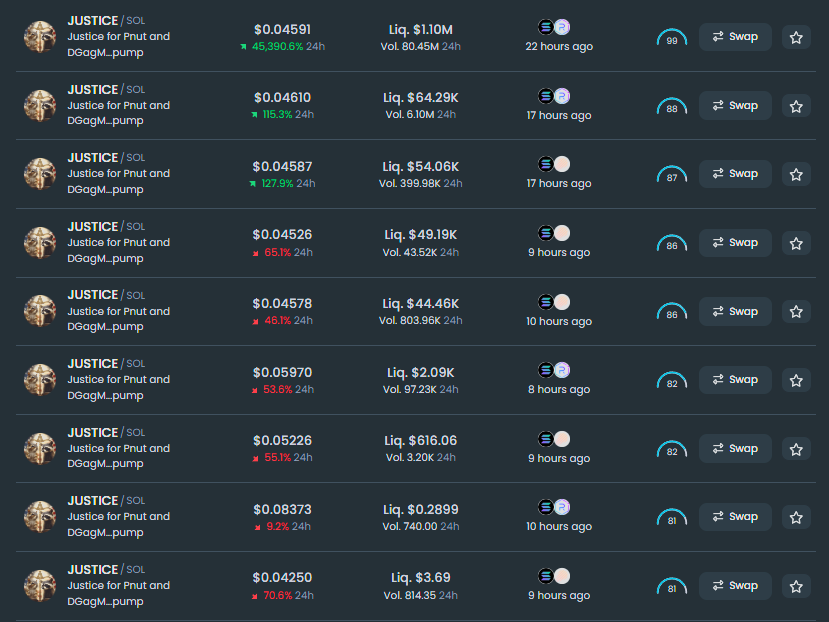

Migration time may be my most important consideration. I avoid anything under 6 hours. Migration is when tokens move from Moonshot or Pumpfun into Meteora or Raydium, respectively. I screen this using dextools (you can find this linked on any met pool on the left sidebar) In this instance, the migration pool is that top one, with the most liquidity and the oldest age. By avoiding early tokens you filter out the garbage that rugs within the first few hours, giving you tokens that have at least urvived the scrutiny of the initial traders and that don't have completely paperhanded top holders.

Regular swaps are important, as they directly make you money. Pools that only swap once or twice an hour will make very little compared to pools that swap every 2 or 3 minutes. In general, the higher the fee the lower the swap frequency.

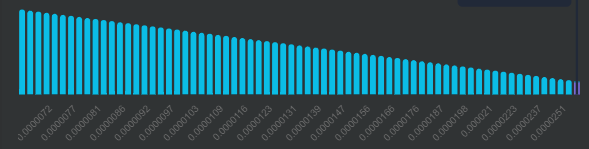

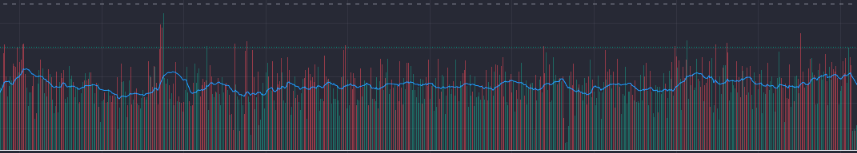

I've found that for 2% pools I like to see swaps at least every 10 minutes, and for 5% at least every 20 minutes. Look at this in the met pool chart. This token has pretty regular activity:

Swaps are very common, with flat candles not being over represented. This comes from a 5% pool, which is actually pretty good for the fee rate. This is the same token on the 2% pool:

Almost no flat candles, very very active. This will print you amazing fees. Compare that to this:

This is another 2% pool on a much more inactive token. This will make you very little.

You should focus on finding pools that print consistently like the first two pictures above, and when they slow down like the third, consider dropping them.

Pool Screening Tools

I Use DLMM Min Fees Opportunities and DLMM Multiday Opportunities to screen pools. The main metric I use is the newly added Lincoln score by Foxtrot. This averages the swaps/min over 1 hour, 6 hours, and 24 hours, then multiplies by the fee rate. This should show you the pools that are the most active, like the first two images above, while accounting for the fee rate. If you LP the pools with the highest score here you should be getting a solid amount of fees.

Lincoln Score Guidelines

You should tailor what lincoln score you expect based on the market environment:

- Sometimes you will get 10 pools with solid scores in the 4-10% range

- Other times you will get 5 pools in the 1-3% range

- Minimum recommended score: 1.5% to open a pool

- Aim for: 3% or more

- Close pools if they drop below 1% (no question)

- Consider closing positions in the 1.5% range

This metric accounts for the fee rate in the calculation, so lower fee pools that are rated highly will have lots of swaps which makes up for the lower fee. If you get two pools with similar ratings at different fees, you should decide if you want potentially more precise tracking and activity, or more downside protection. A 1% pool may better track the price and give you more swaps from tight volatility, while a 5% pool will be much more favorable if the token dumps quickly.

Volume Analysis

I also look at the raw volume, where I use a moving average on 1 minute candles. On tradingview plugins, such as in dextools, you can enable it by clicking on the dots next to the volume, settings, and clicking on the moving average.

Moving Average Settings

- MA length: 20

- Smoothing Line: "SMA"

- Smoothing Length: 9

Check the volume on the biggest pool, usually the raydium migration pool. You can also do a sum of pools like offered by birdeye.

This token here has strong volume, with the moving average at the mountain at the end being $60K.

This token doesn't, the moving average is around $2k at max, the average being around 500.

Aim for that first token, you will see more price movement and volatility, so more swaps in your pool and more fees.

Other Considerations

- Market Awareness: Sometimes there will be 6-12 good tokens to make positions for, other times there may be only 1 or 2. Adjust your expectations to this market. If the market is good, raise your requirements and rake in the profits.

- Avoid Tops: I try to not LP tokens if they run up exponentially without any sign of stopping. I've found the risk of a sudden and violent dump to be too much for me. By all means, enter these and pull in the fees if you can stomach that risk.

- Avoid Botted Pools: I tend to stay away from tokens with volume bots, which can be easily seen where the volume will be very rectangular, with basically a floor that is never passed. I find these tokens may dump violently when the devs turn off the bot and sell their bags.

This is a botted pool's volume.

Notice how the price here dumped quickly once the bot was turned off.

Also consider Metlex's dlmm100 and magical tools for pool screening. Foxtrot has other sheets for pools you can find here DLMM Opportunities | Linktree

How to not get rekt: Portfolio Management

It is critical to reduce the volatility of your portfolio as a whole to avoid being completely burned. I currently allocate around 2% of my wallet to each position. If you want to be more aggressive, aim for 3%-8%. More conservative could be 0.25%-2%.

I prefer to run many positions at once. In the range of 10-40. This reduces my risk massively, as any loss can be absorbed by the other positions printing. This allows me to come out with a profit on the day something like 90% of the time. You shouldn't feel stressed or worried about your overall performance.

I like to keep my positions each open in a tab on my computer, grouped by their status.

I put safe positions that are less volatile in Chill, I often have had these open for a day or two.

Position Grouping

- Chill: Safe positions that are less volatile, often open for a day or two.

- Danger: Positions at risk of going out of range (to the bottom) or other volatile positions.

- Fresh: Positions opened that day or extremely dangerous positions, monitored the most.

Tracking Performance

To keep track of your wallet’s performance use Meteora DLMM Profit Analysis v3.0.

To see your open positions’ precise performance use DLMM live data

I use Asset Dash to track my overall wallet on web and on my phone: Referral Link

Also use my code: HNWA-HOGX for some bonuses for me and yourself.

Closing

That's just about everything I can think of to include here. My hope is that you can all learn something from what I have developed over the last 3 months of DLMMing. If you start to turn a profit using these tips, let us know in the Meteora discord! I would love to see real results from other people employing my low stress method. Good Luck!

Disclaimer: I am not responsible if you lose money. I am trying to help you become profitable, and am not in any way telling or encouraging you to take financial risk. You alone are responsible for your actions.

All contents are licensed under Creative Commons by-sa.