Meteora DLMMs guide

Liquidity is the blood of Decentralized Finance. dApp protocols are mostly based on contributions made by people lending their tokens. Because we put our digital assets at the disposal of dApps, they can propose financial features.

Providing liquidity is often rewarded. This incentive allows providers to put their holdings to work while limiting risks. The act of providing liquidity is now widely spread and part of most portfolios. Especially with recent point reward systems that make incentives stronger.

That's why it matters to understand the different protocols at disposal. As a wise trader, you have to be familiar with these concepts to be able to track and balance them well in your portfolio.

Each protocol has a different way of managing the funds its community brings. In this guide, we will focus on liquidity used by decentralized exchanges. They are named liquidity pools. They require you to provide a pair of assets (say JUP and SOL). With them the exchange can provide swap features to their users. Providers are rewarded with the fees collected during the swapping to incentivize them to let their liquidity. This concept was originally created by Uniswap and is now the basis of any decentralized exchange.

To maximize their effect, these pools were improved with the appearance of concentrated liquidity pools. This new kind of pools faced several limitations. To fix that problem, the Meteora team, who already provided pools for exchanges, developed a new kind of pool named Dynamic Liquid Market Makers. These pools are designed differently to be even more efficient and most of all more playful to deal with.

This is the reason behind this guide. Because they are capital-efficient and playful, DLMMs can be a great tool to put your portfolio to work. So, I wanted to ensure that you know everything to manage them properly. In this guide we will first cover first the basics of DEX liquidity providing. Then, we will explain to you how DLMMs work and why they do better. Finally, we will explore strategies you can set up thanks to DLMMs while contributing to the ecosystem.

1. Trading Pair and Liquidity Pools (pools)

A liquidity pool is like two buckets where you put an equivalent amount of two tokens.

Decentralized Exchanges (DEX) rely on these pools to allow you to swap your tokens at any time without any order book. They aggregate the liquidity of many liquidity providers to constitute huge pools that traders can use to swap their tokens. When someone does a trade, the DEX consults an oracle (like Pyth Network or Chainlink) to know the market value and then grab the amount of tokens required in both buckets.

So, if you want to provide liquidity to a pool, let's say you want to set a SOL/USDC swapping pair pool, you can start with lending 1 SOL and 150 USDC to set it up. Once done, it allows people to swap these two tokens as long as they are enough of both in the pool. Your liquidity aggregates with the ones set by other, which allows DEXes to do bigger transactions.

2. Liquidity Pairs Farming (LPs)

When you fund an LP pool, you are rewarded with a percentage of each transaction occurring in the pool. What we name farming is the fact to collect these fees to augment your holdings.

In some way, it allows you to get rewarded for providing your holdings, but it comes with the risk of impermanent loss, which may lead you to end with a single token from your pair (we'll cover it in detail later).

So, if you believe in both tokens of the trading pair you fund, impermanent loss is not a problem. Providing liquidity pairs is a great way to grow your bag without worrying of market variations. By accumulating fees, you will earn a recurring yield on your positions without trading anything.

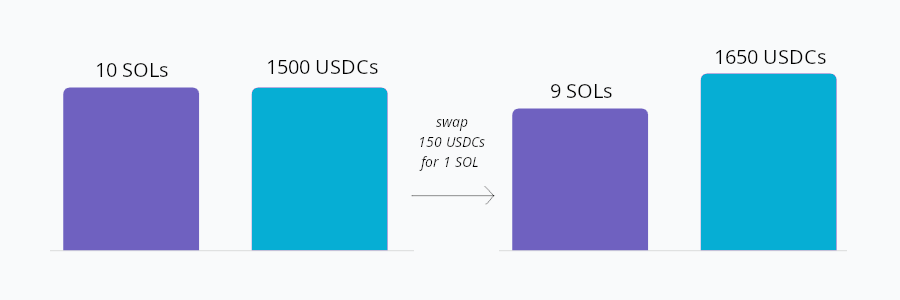

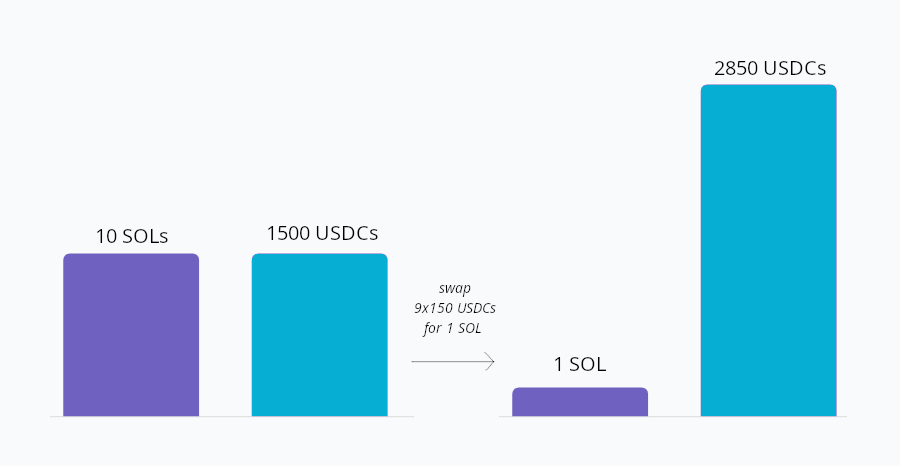

3. Impermanent Loss (IL)

The drawback of providing liquidity is that you will suffer from Impermanent loss. It means that when one token gets more value over the other, your pool will get rebalanced, and you will accumulate the token with the lowest value.

If you look at our two buckets, you get that if swapping only operates on one side, at some point, one of them is emptied while the other is overfilled.

If you are confident in both tokens or want to gradually sell your tokens with a USDC/something pair, for instance, you won't have to worry much about this aspect.

Moreover, as long as you don't withdraw your funds, they will rebalance with the market. If your sol went down and accumulated many of them, they will be sold when the market is up and vice-versa. So, if tokens go both up but in a different time frame, you will keep the same proportion of tokens in the end. It's the best that can happen because you collected fees while keeping the same holdings.

Because of Impermanent loss, selecting the right pair is key in LP farming. The risk management occurs around IL when farming. That's why you should always consider every scenario before setting a new pool.

4. Slippage

When a trading pair is very volatile, if you execute your order, the price may change between the time you initiated the trade and the time it is executed. That's why DEX propose you to limit it, to avoid bad surprises. However, slippage leads to rejected transactions if the limit you set is too short.

As a user, you prefer to see your order executed instead of being rejected. So, DEX always looks to avoid this problem as much as possible. The fewer rejected transactions, the better the experience is.

5. LP Efficiency and Concentrated LPs, aka Concentrated Liquidity Market Makers (CLMMs)

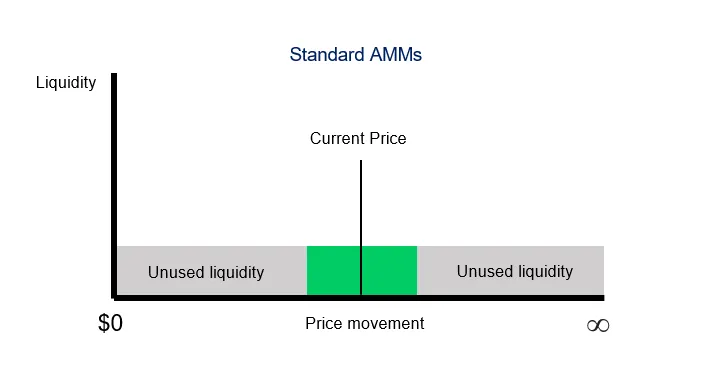

Aside from ILs, an issue you face when providing LPs is that your capital is unused most of the time because it covers the full range of possible trading variations. It means that a significant part of what you provided generates nothing.

To help with this problem, DEX proposed concentrated LPs, where the fees are collected on smaller ranges. It makes the capital more efficient but leads to stronger ILs. It requires much more attention and to reset your LPs on a regular basis. Initially, LPs covered the full range of trading. It was easier to manage, but in that case, a lot of your funding is sleeping, and the rewards are pretty low.

To tackle this problem, CLMMs allow us to put more capital to work. However, it requires more active management. You often face the case where the pair price exceeds the range you set. In that case, you must withdraw your LP and consider your next pool setup.

6. Meteora Dynamic Liquidity Market Makers (DLMMs) and What's new

A. less slippage, more fees

The DLMMs from Meteora arc CLMMs that split the whole pair in smaller bins instead of a single bucket where repartition is smooth. That way, you have a dedicated amount of capital for each pricing step.

DEXes enjoy it because it allows them to make very efficient trading on small ranges of pricing and avoid many slippage use case.

For traders, it will allow them to always use the right bin and limit rejections. The experience is better.

For you as a liquidity provider, it means that your capital will grab more fees because more transactions will succeed.

B. Visual representation

The main benefit of bins is their visual representation. It's easier for you to figure out what is happening. The Meteora UI adapts your bin position in real-time, which makes things even clearer. It helps you understand what is happening and create different strategies.

C. New strategies

Thanks to the bins, you can choose where to collect more fees. Before DLMMs, you could only set your fee collecting on a specific range. But now you can decide the range and the balance of where you collect more fees. We will give you later examples of strategies you can set up.

7. How to deal with DLMMs?

There is no one way to start with LP farming and DLMMs. I propose there an approach to start with them but feel free to adapt it to your style.

You can start your DLMM journey with stable pairs. It will be the safest pair to understand how DLMMs work. The Impermanent loss has no impact because both pairs have almost the same value. So you can make mistakes safely.

To set your pool, the UI is pretty straightforward. You have to select the USDC/USDT pool from the list and create a position by putting an equivalent amount of USDC and USDT. Then, Meteora proposes three ways to balance your pools:

- Spot: every price range is filled with the same amount of tokens

- Curved: The price range in the middle is the most filled. You assume there that the price will evolve little and that most trades will be concentrated.

- Bid/Ask: you assume the price will go back and forth, and so you prefer to put more liquidity in the low and high part of your range.

Once you confirm, the pool is created. It takes a moment to process. Then the pool is set. From there, you can see in real-time how it evolves. Take the time to look at it to understand better how DLMMs work.

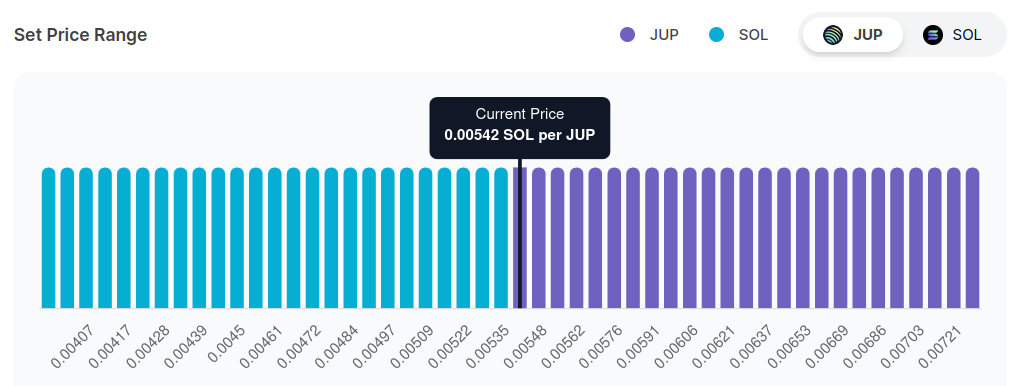

Once you are comfortable with stable pairs, you can set pairs with the tokens you believe in, like SOL/JUP. Both should vary the same way. JUP is the main DEX of Solana, so SOL movements will significantly influence its variation. Plus, ending with only JUPs or only SOLs is ok. While it's not a stable pair, it's still a pretty safe pair.

You can open several small positions for a few days with different ranges. You can Also, change its configuration over time depending on the market condition (it will require withdrawal and deposit again). You will better understand how fees are collected and how impermanent loss behaves. Once you are more comfortable, you can put in bigger amounts and enjoy your DLMM journey.

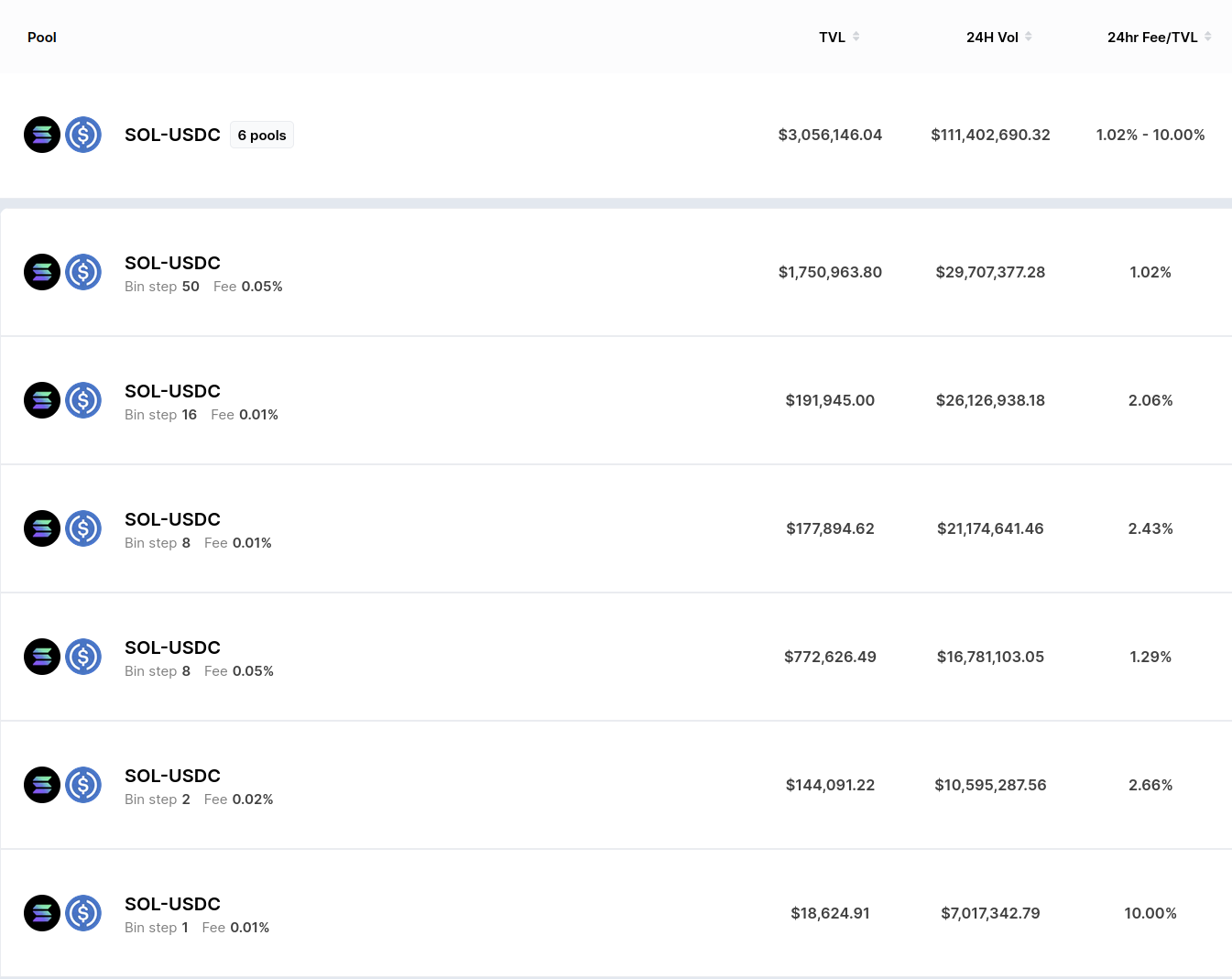

8. How to choose the right pool?

Aside from providing liquidity to the ecosystem, the goal of setting pools is to optimize the collection of fees.

So, the first thing to check about a pool is the fees collected daily. Once you have this information, you can do some maths to get the % of the pool you will own after you add funds. Then, you can apply this % to the fees collected to know what you could expect.

Let's illustrate this and say you add 1 SOL and 150UDSC to a pool containing 10 SOLs and 1500USDC, it means that every day you will get 10% of all fees collected that day by the pool. With DLMMs, it's more subtle because your strategy will influence this number. But it will give you a rough idea of what to expect.

The consequence is that to select a good pool, you should look for a good Total Value Locked (TVL) / volume ratio. If the volume is too low compared to the TVL, it will mean that this pool catches too few transactions and is not efficient. On the other hand, a pool with a low TVL that catches a lot of volume will be pretty efficient. But this pool usually operates on a low range and gets out of range quickly. There are always pros and cons in selecting pools.

Meteora provides another indicator named 24-hour Fee/TVL. The higher it is, the better. But you do not have to be too greedy. Sometimes, a high 24-hour fee means a lot of volatility, and the probability that your pool gets out of range is high. A number between 0.4% and 1% is fine. If you are above 1%, you can consider that the risk of fast impermanent loss is high. So, you will be required to manage your position accordingly.

The other indicator to take into account is the bin step. It shows how wide the pool bins are. The lower the number is, the more concentration there is. The pool with small bin steps will allow a few strategies and will get out of range faster. But, of course, they capture more transaction fees within their range.

Once your pool is set, check regularly the 24-hour fee percentage your pool has. If it is too low compared to the pool average, consider changing your strategy.

8. DLMMs strategies

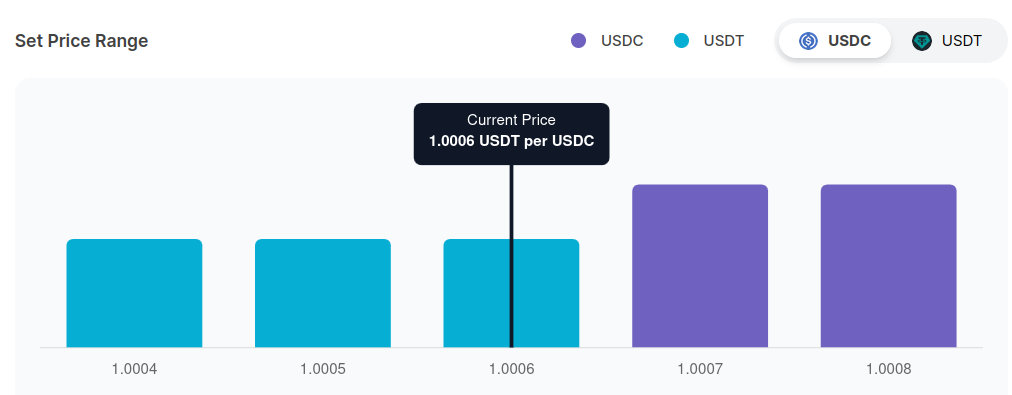

A. Very concentrated ranges: stables and pegged tokens

Pairs like USDC/USDT or Sol/bSOL always operate on the same range. These pairs are less rewarding, but there is no problem with IL because both tokens share a similar value. So, we can afford to set a very thin range to get a maximum of fees. If the price goes out of range, you can close the position, swap half of the balance, and open a new position with a new range.

We'll work on the USDC/USDT pair to illustrate. If you look at the trading pair chart in a 3-month range, you will see that the price mostly evolves between 0.999 and 1.001. The bar on the left shows the volume that occurs for each pricing range.

The goal here is to set the pair bins that the pool will use to swap tokens. Because you want your bins to be used fully, you will set bins only for a range that matches the price where the trading volume occurs.

That way, your pool will almost always work at high capacity. If you are ready to reset your position frequently, you can focus even more by using only 2 to 4 bins. It will require more work on your side (once you get out of range, you must withdraw and swap half of your tokens to set a new pool again), but the fees are collected much faster in that case (I observed a 2x ratio between a 4 bin DLMM and 12 bins DLMM).

Another option is to use more bins but fill them with the curve strategy proposed by Meteora.

B. Similar tokens

Most of the time, the best option is to set a pool of two tokens you're confident with, like tokens operating in the same area or tokens correlated to the SOL success. For instance, the JUP price is somehow linked to the evolution of SOL. If you believe in Solana and its ecosystem, ending with only SOLs or JUPs is fine. So, it's okay to set up a JUP/SOL pair.

In that case, you are going to set a range that is wide enough to make you look at the LP only once a day. We'll use the spot strategy. The price can still be volatile and do some swinging. It's a bit hard to predict that's why we prefer the spot strategy. But if you feel like the pair has a tendency to be stable, use a curve strategy.

C. Selling Limit

Here, we will deal with tokens that have much more volatility. We assume that a token A will see its price rising significantly compared to another token B. We want to sell it for double its current price. But we are ready to accumulate more if things go the opposite way.

For that, we set up an ask/bid curve, and we extended the price range on the token A selling side and shortened it on the token A buying side (= token B selling side). Note that you can soften the process by using a spot strategy. That way, we obtain a curve that swaps heavily if we go on the unexpected side and that swaps a little in the opposite way until the token price reaches the expected limit, where we make things more intense.

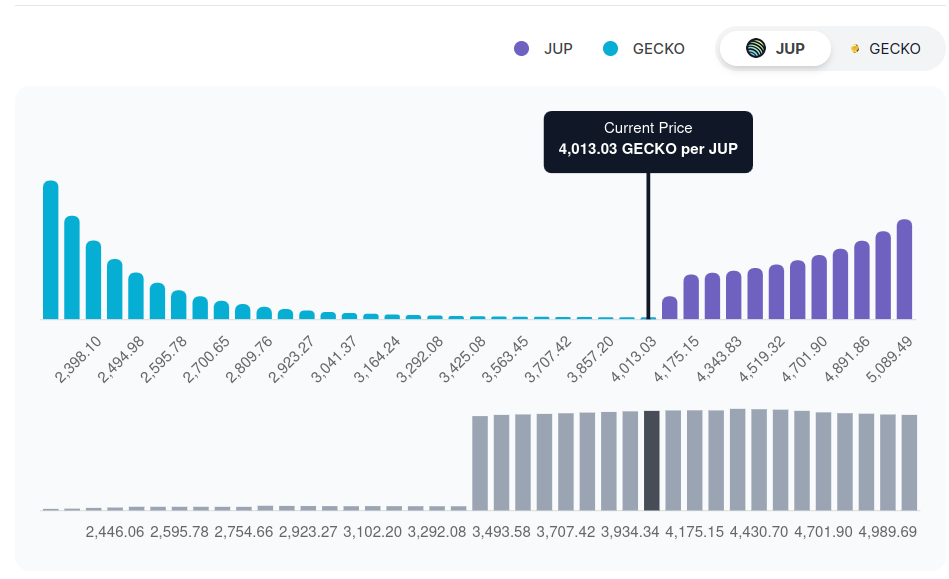

Let's see how it looks for JUP/Gecko pool, where we want to sell our Gecko at approximately x2. Here, we set an ask/bid strategy and expanded the left side of the pool while extending the right side:

D. Swinging pairs

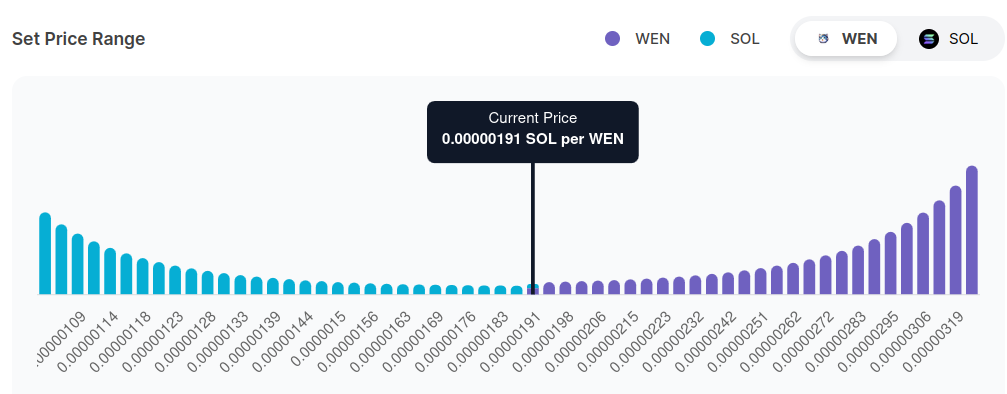

It's common that for a few days, a token pair swings a lot. If you identify a pair swinging heavily in a given range, it's the opportunity to use the ask/bid strategy proposed by Meteora. See below a WEN/SOL pair swinging heavily.

To deal with it, you can simply use the ask/bid option proposed by Meteora. But if you feel like it's too light in the average range, you can combine a spot strategy with half of your tokens with an ask/bid strategy on top of it, with the rest of your tokens (you can add tokens on an existing position with a different strategy).

E. Acquiring a new token: one-sided pool

DLMMs offer you a new elegant way to acquire a token. You can set a one-sided pool, a pair filled with only one token. That way, you can set an entry price range where you can start to exchange your tokens for other tokens.

Let's say you want to buy SOLs only when it reaches $140 and then gradually buy it until $130. You can set up a SOL/USDC pool that will fill bins with USDC only between $140 and $130. That way you will be able to gradually buy SOLs and capture fees at the same time.

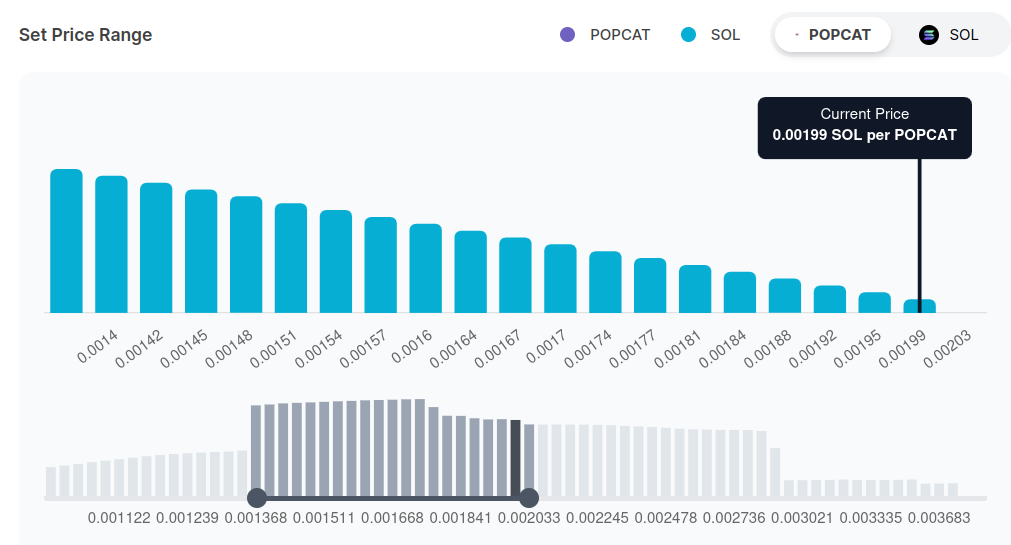

Let's take another example and have a look at buying some POPCATs with SOLs. Here we see that gradually enter the token via a simple bid-ask option by putting only SOLs into the pool:

Conclusion

DLMMs is a new opportunity to put a portfolio at work while having fun. It requires to be active to be fully efficient. But, it can be pretty rewarding and it helps the ecosystem to thrive. If you set them well, you create a win-win situation for you, for the token project, and for Decentralized Exchanges. Therefore, I encourage you to dig into them and play with them.

Last but not least, Meteora has a vibrant community of farmers. I recommend you join their Discord to have even more fun.

Sidenote: If you want to avoid managing them, Kamino offers products that will do the work for you. On my side, I prefer dealing with them directly, but I understand if you want to set it and forget it.

Resources

Tools

- DLMM utilities: fees count, transaction P&L, active pools, pool search (Metlex)

- DLMM P&L analysis (Geeklad)

- DLMM P&L and fees listing (ISC)

- DLMM portfolio

- Impermanent Loss Calculator

- Highly active pairs from the last 24 hours (Spreadsheet)

Resources

- Meteora Youtube Playlist: Bootcamps and JAM sessions

- Helpful Discord message

- Meteora Bootcamp Slides (old version)

Additional Tips

This part goes beyond the general theory. I share what I do and what was profitable to me to help you with your DLMMs setup. There is no scientific approach behind this. It's a simple return on experience.

Stable pairs

- The key is to experiment with many combinations and find the one that fits with you.

- You have to look for concentrated positions. But the more concentrated, the more you need to rebalance.

- For USDC-USDT, my favorite position is to use 2 bins from 4 bin-step pool. No need to swap on Jupiter, Meteora will balance the pool for you.

- For Sol pairs, you can use a short range too. But, because of the nature of LST tokens, your pair will turn fully into Sols at some point. So, the shorter the range, the sooner you will have to rebalance.

- Because you use short range, the spot strategy is better.

- Duration: you can keep this setup forever.

Strong SOL Pairs

- The goal is to keep the pool in range as much as possible.

- Use a wide range by using large bin-steps.

- The curve strategy works better because we can guess that the strong token of the Solana ecosystem (JUP, Jito, KMNO) will follow the SOL variations.

- When a pair has a lot of volume, you can open several concentrated positions that overlaps slightly each other.

- Duration: months (set goals based on fees, duration or token gains)

- It implies trading strategy, impermanent loss can lead to lose some funds.

Buying or selling a token

- Sometimes it's simpler to buy a token via a DLMM pool.

- You avoid fees and slippage.

- You grab a few fees.

- When the chain is overloaded it tends to work better.

- The buying may fail due to the price never reaching the range you set.

- To achieve that you create a position with very few bins with a spot or bid ask strategy.

- It works in both ways: buying and selling.

- If you want to do a progressive DCA, you can use more bins or wider bins.

SOL - Meme pairs

- These pairs are much more risky. Bet only with a small percentage of your portfolio.

- Identify strong meme coins with a good trading volumes.

- When the SOL market is in a good shape, open 3 or 4 double-sided positions. Some of them will go wrong, opening several positions at the same time will mitigate risks.

- To limit risks even more, you can open a single-sided pool.

- Let the position evolves, grab fees and sell them immediately against SOL or USDC.

- If the position gets significantly in the upper range, close it and sell the remaining meme tokens. You are already in profit, so take advantage of it.

- If the position gets outside of the lower range, it's wiser to sell everything to mitigate impermanent loss.

- Duration: 2 hours to a few days

- It implies high risk trading strategy, impermanent loss can lead to lose funds.

New Token pairs

- These token pools are very risky and can lead to the loss of all your funds.

- Use only small capital amount.

- Stay in front of your computer during the process.

- Join a DLMM community like DED LP Army, Goose DAO, or The Whales NFT and trade with them.

- These tokens can rug at any time, in that case, your funds are lost.

- Use only single-sided SOL pool

- Wide bins are fine (like 250 or 400).

- Use only pools with 2% or 5% fees.

- Only 1 or 2 tokens a day are worth LPing.

- After a significant pump in the price action, open your pool. Then wait for a dip and its recovering. Close the pool, sell the fees and wait for new tokens.

- If you decide to keep the pool open, sell fees regularly.

- If it dips outside of your range but you feel like it can recover, close the pool and open a new pool with a bid ask strategy to sell your tokens at decent price when it will recover.

- But most of the time if the pool goes outside your lower range, take your loss: close the pool and sell your tokens.

- If you get 20 to 30% of your investment, it's already a great session stop there.

- Duration: 10 minutes to a few hours.

Bonus chapter: Communities

Managing proper positions can be tedious. That's why I recommend you to join the following communities to get help and tips from other users:

All contents are licensed under Creative Commons by-sa.