Tensor Quickstart Guide

After trading for a while your NFTs on Magic Eden, you will notice that there are a lot of fancy stuff that comes into your way. You will feel a little bit limited and think that things could be more straightforward. You are trading on a regular basis and understand that you need more advanced tooling. But what to chose next? Good news, a platform recently emerged solving this problem: Tensor Trade.

This platform initially is designed for pro-traders. But, for a casual trader, it is a very powerful tool too. That’s why I wrote this guide that will help you to take the most out of Tensor in a few minutes. It covers the main features you can use to improve your NFT trading on Solana.

1. List hot and favorite collections

Collections List

The biggest strength of Tensor is its hot collection list. It’s super fast to load and it shows you all the main information about a collection: floor price, 24h volume, 24h floor price change, number of elements listed. In a glimpse, you have information needed to make your buying or selling decisions. It’s the first thing you see when you connect to the website.

Bonus: Everything is updated in real-time, you don’t need to refresh your browser. Your tabs can stay open.

Filters

Most of the time, you don’t need to see the collections you can’t afford. For instance it’s not that interesting to see Degods on the top of the list. If you can spend 50 sols at maximum, you don’t care about their current floor price. For this reason, the Collections list can be filtered very easily.

With filters you will be able to remove everything above your maximum investment capability. In the same vein, you will be able to filter collections with low volume. It will remove many false positive. In the end, with a few clicks, you will see the hot collection of the day or week in your investment range.

There are too much data flowing in the NFT market while you need focus to make good investments. Tensor removes the fancy stuff in both ways: through its clean UI and with the filters that cleans noise from the data.

Favorites

It’s common to follow only a given set of collections. You did your researches about them and want to track only the evolution of the collection with the biggest potential.

To make things easier, Tensor allows you to mark collections as favorites. You can mark a favorite in the collection or directly in the search results via a research in the search bar (which is very handy)

Then you can ask to only shows your favorite collections and watch their main information. Similar to the filter, it allows you to set up lists of interest quickly.

You can manage three lists of favorites, via the bottom bar if you need to classify your favorites:

2. Manage your inventory

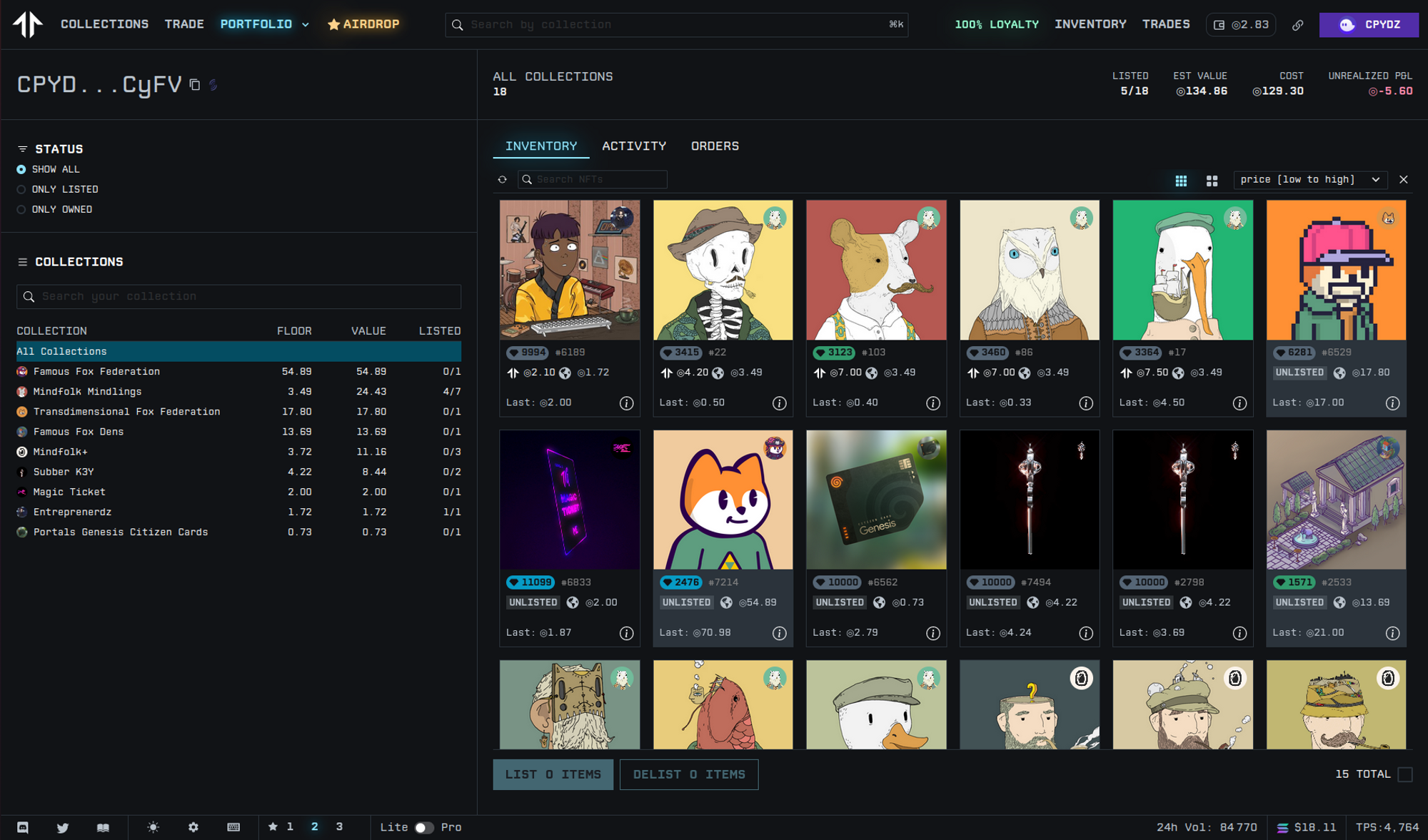

Display inventory

There are two ways to display your inventory:

- Clicking on the top right “Inventory” button. It Displays a panel giving you a quick access to it with a recap of all floor prices and buttons for quick access to the related collection. You can click on any NFT to list it.

- Or by using the Portfolio button in the top left menu. From there you will be able to display your inventory in a full page. Everything is summarized on the left. On the right you have access to all your NFTs. By clicking on them you will be able to list them via a dedicated modal window.

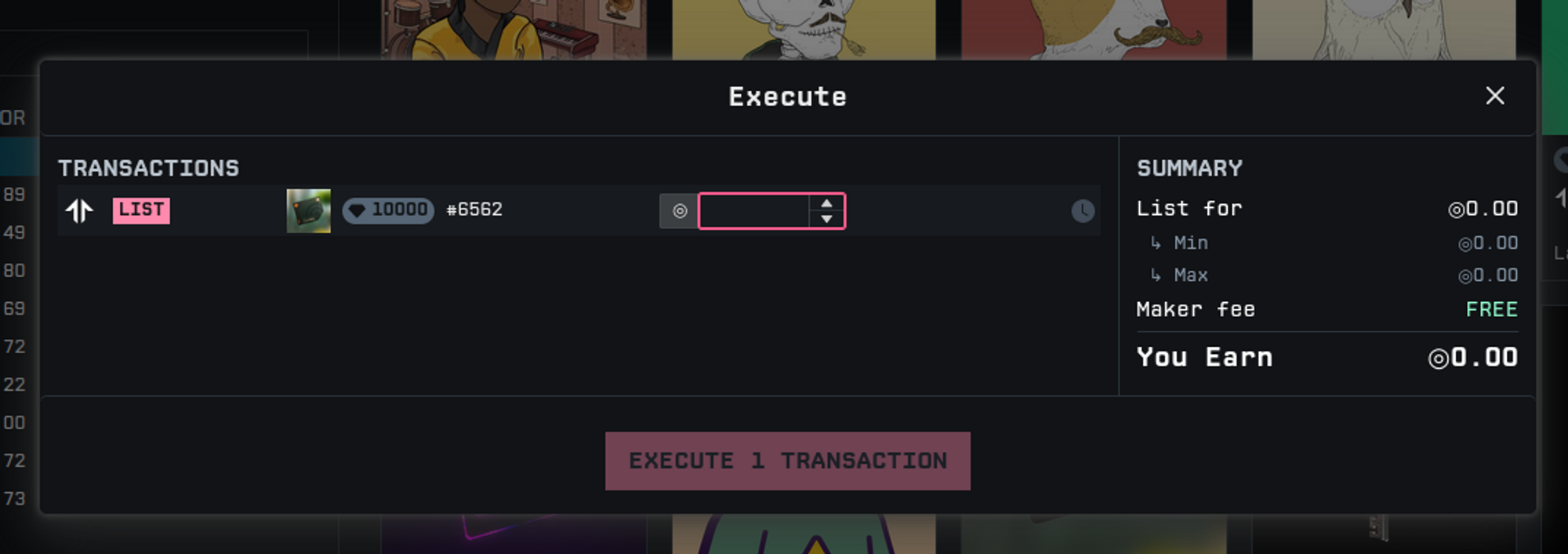

The listing modal:

You can list your NFT with a similar mechanism but remember that the moto of Tensor is efficiency, so no confirmation will be asked. Be sure before setting a list price.

3. Trade your NFTs

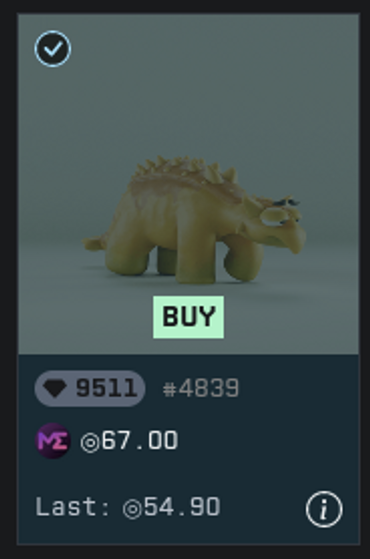

Buy and list NFT

I won’t cover here the buying and listing of NFTs because it’s very straighforward. When you put your mouse over a NFT, it proposes you to buy it if you are browsing a collection, or selling it if you are holding it. Tensor allows you too to swap your floor NFT with another one from their liquidity pools when swapping is available.

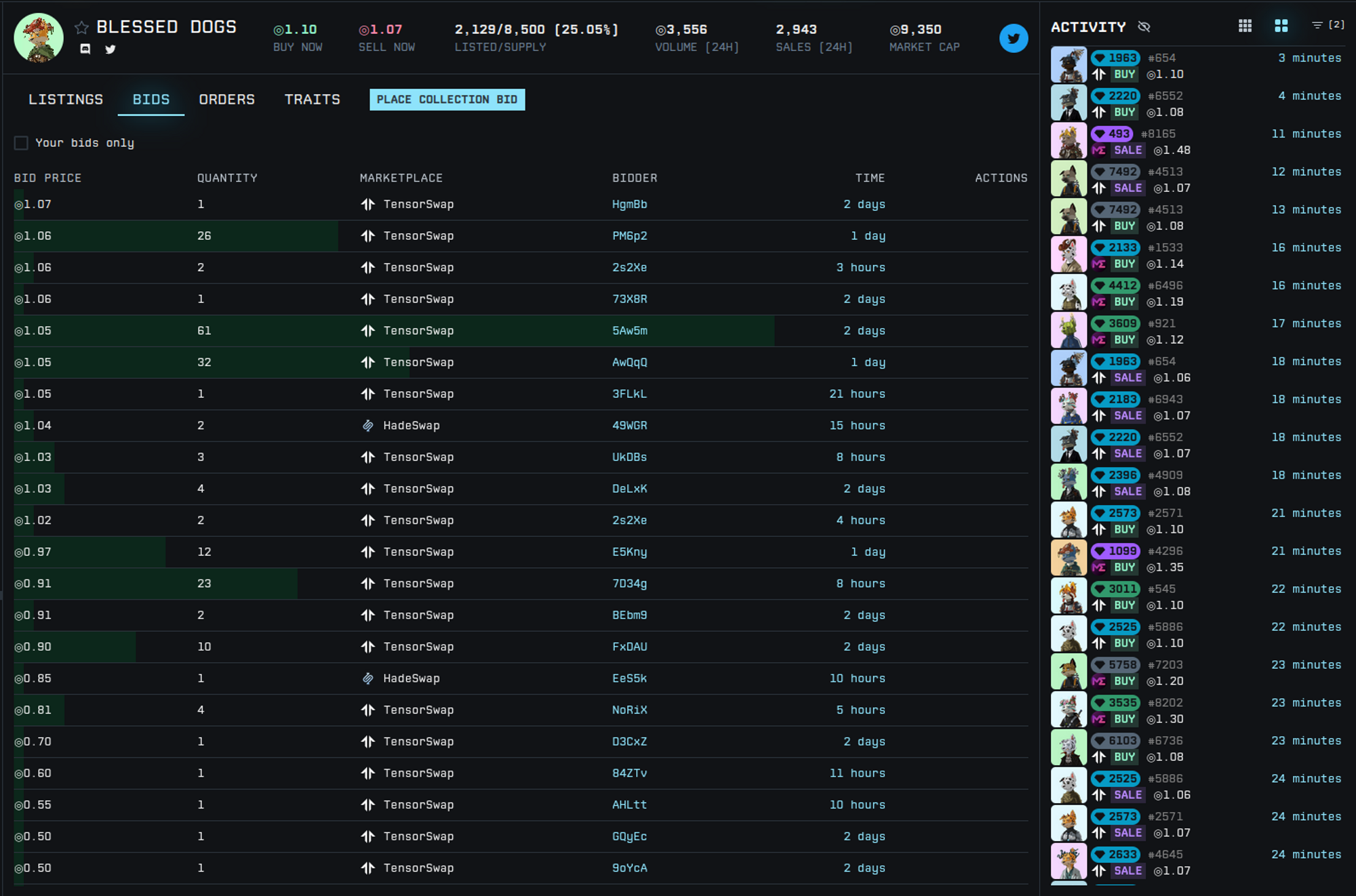

Collect information on collection: recent activity, rarities and more

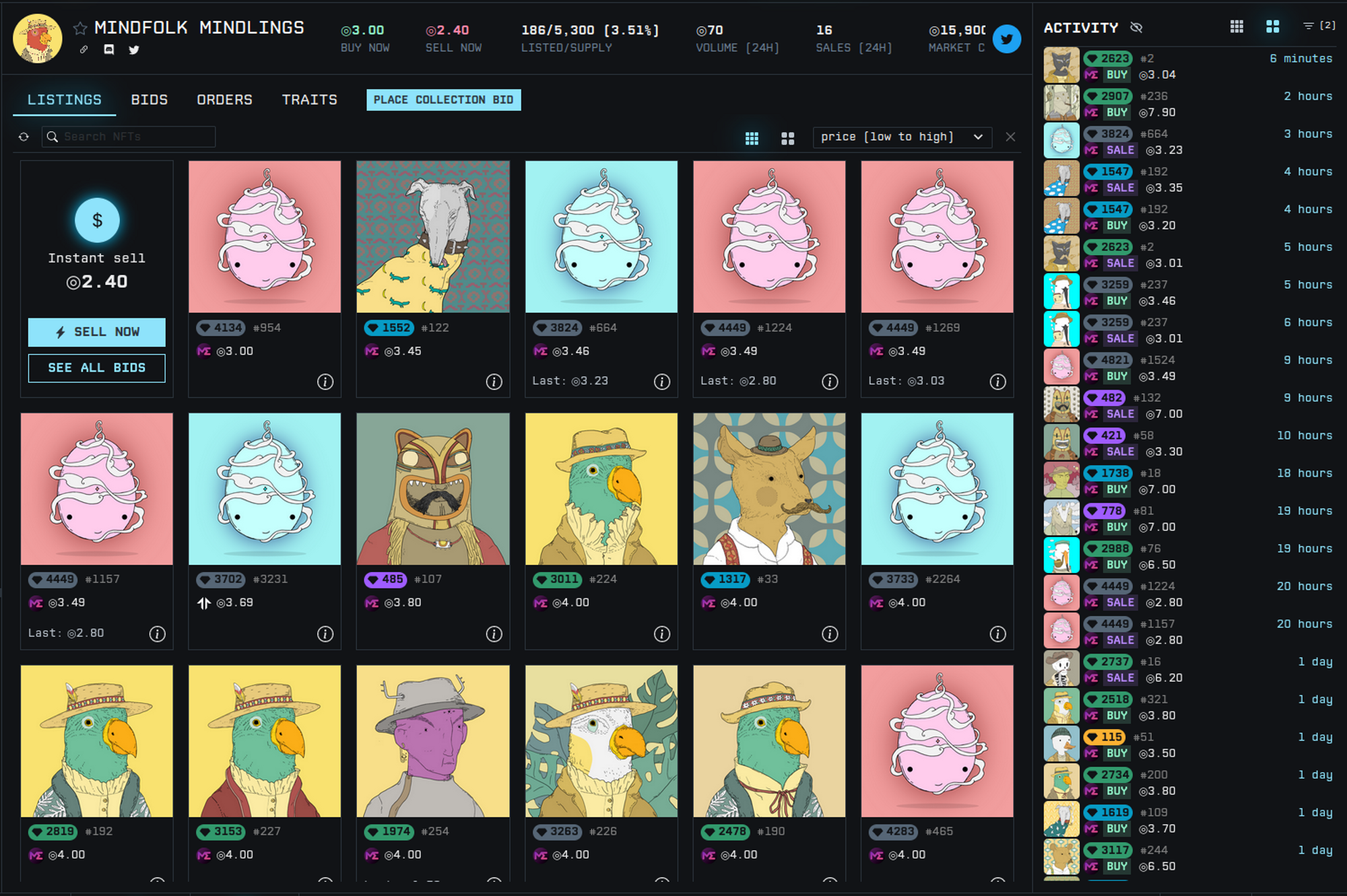

Another strong point of Tensor is the data displayed when browsing an NFT collection. On the same screen you can have:

- The price evolution

- The main collection statistics (listing, volume, …)

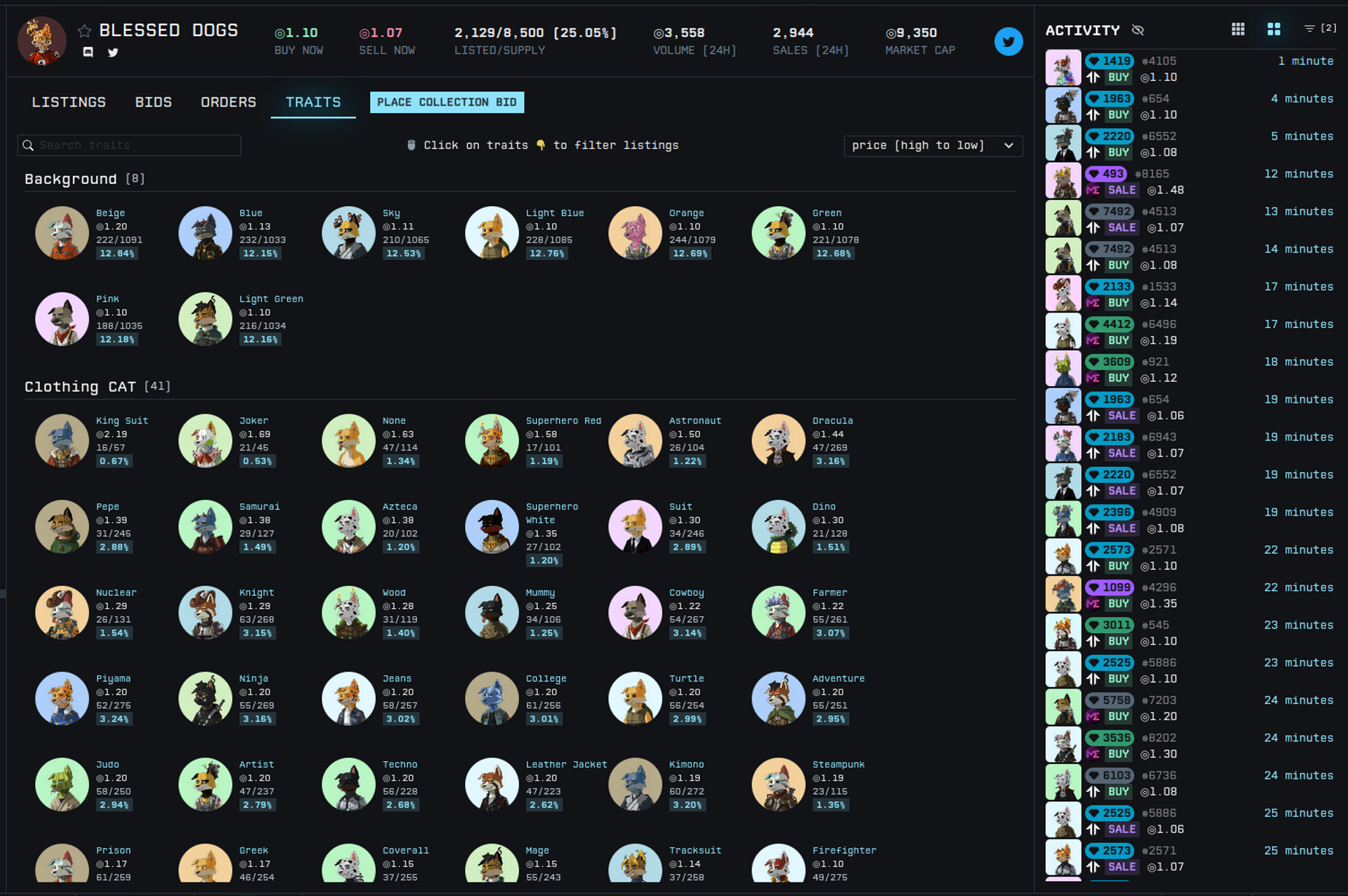

- NFTs price and rarity levels in a form of pictures or list (it requires to switch between light and pro mode via the bottom bar)

- The recent activity

Another strong point is the fact is that there is tab showing book order walls to guess the upcoming resistance:

And a tab to track rare traits floor price:

With all this data at hand, you have everything you need for your buying decision whether you want to buy at floor price or looking for rare pieces from the collection. Tensor truly empowers you for a maximum efficiency.

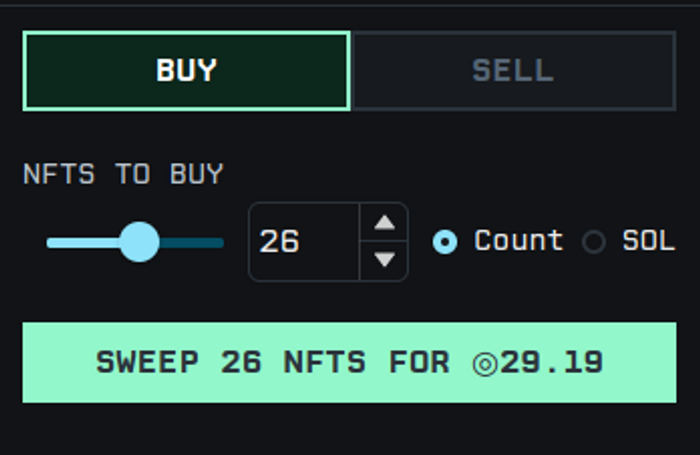

Floor sweeping

A floor sweeping tool (and the equivalent for buying) is available right in the application which is pretty convenient to invest heavily in a collection.

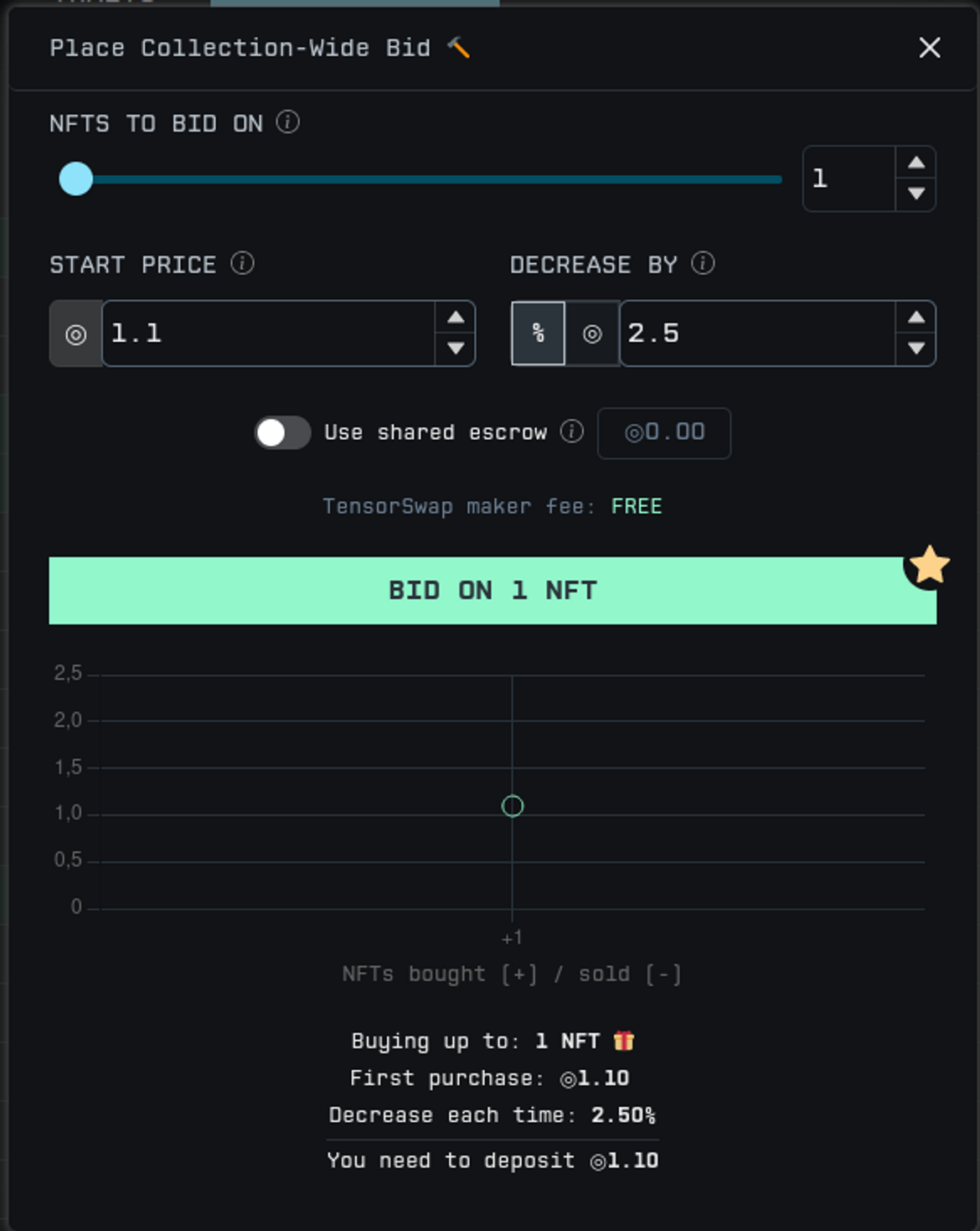

Bid a collection

Another very useful feature is the capability to bid a collection like in Magic Eden. It allows you to provide quick exit liquidity for holders who need to sell their NFT quickly. You set a price and anyone can sell his NFT to you instantly. That way, you can accumulate NFTs from this collection at a price below the Floor price. You can set multiple bids if you want to gradually buy a collection of which the price is going down.

AMM and Swing Trading

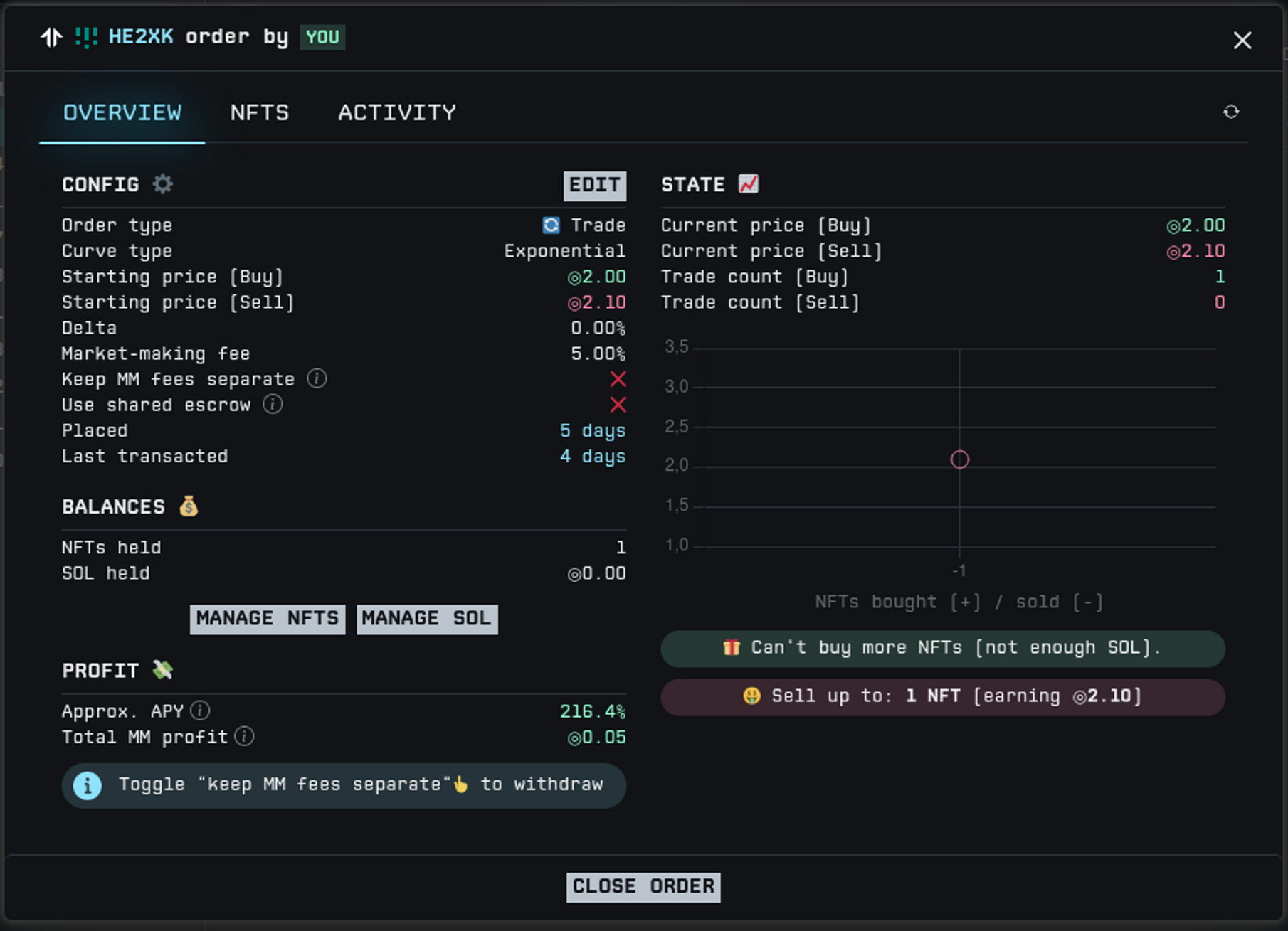

One of the main product of Tensor trade is the Auto Market Making feature. It’s more aimed at big holders or collection managers but it can be useful to you too. The idea is to provide liquidity to a collection. You provide both sols and NFTs and set buy and sell prices. Your sols are use as buying bids on the collection while all your NFTs are listed at your sell price. So when the price moves around your buying and sell price, tensor will automatically buy and sell the collection NFTs. It will allow the other users to do quick buys or sells and you will accumulate sols from the margin done at each sale. The only issue is when the price leaves the price range. You have to either wait until the price range is reached again or modifiy it to adapt to the new accumulation zone.

Here is a very simple example of AMM settings for a single NFT:

Notifications

You can set email or mobile notifications to always be aware when something happes with your wallet: bid accepted, NFT sold, on AMM doing operations.

That’s it for this Tensor quickstart guide! I hope it was useful to you. If you don’t know this tool, I really encourage you to give it a try. I show you that it gives you a very fast UI to do your trading and provide you with all the data you need to take your decision. It definitely has its place in your daily NFT trading routine.

You will find more information in their official documentation: https://docs.tensor.trade/welcome/about

I would be glad to have your feedback about my guide, so feel free to contact me on Twitter to give me your thoughts! Thank you for your attention!

All contents are licensed under Creative Commons by-sa.